payday advance cash loans

Dharavi Endeavor: Maharashtra lets Adani to construct homes for slum endeavor-strike someone to the Mumbai salt pan property

Mumbai Pantry approves playing with 255 miles away from salt pan house to have slum treatment, that have Adani class controlling the endeavor. Almost every other key conclusion include financing toward Thane Band Location, canal roadway projects, financial assistance to have growers, and you may growing allowances getting Family Shields.

Delivering that loan to become simple having ULI: Borrow cash in place of credit history, salary otherwise money facts; ULI launch time, almost every other info

This new Put aside Lender away from India (RBI) is set to revolutionise this new credit landscaping into the India having its then Good Lending Interface (ULI). So it electronic platform aims to streamline loan procedure, to make credit far more accessible, particularly for outlying and you will less consumers. By the aggregating data from certain sources, ULI have a tendency to facilitate mortgage approvals and reduce the full time it takes to receive money. Just how will ULI really works? Commonly ULI function as the 2nd UPI?

Commonly this new Government Reserve slashed interest rates prompt enough to submit a ‘soft landing’?

Envision Kelly Mardis, the master of Marcel Paint when you look at the Tempe, Arizona. Regarding one fourth off Mardis’ organization originates from real estate professionals that preparing homes for sale or out-of new home people. Buyers inquiries, the guy remembers, rapidly dropped nearly whenever Fed already been jacking up rates of interest from inside the .

Bajaj Houses Funds against PN Gadgil & 2 almost every other IPOs: Which is the smartest choice?

Investors enjoys five IPOs to select from, that have Bajaj Houses Financing emerging since the finest come across on account of its solid parentage, varied enterprize model, and you may good financials. The brand new IPO is anticipated supply an excellent allocation chances and you can strong listing gains. PN Gadgil Jewellers are a holiday option for a lot of time-title dealers.

SBI nature hikes interest levels within these funds because of the loans New Canaan ten bps; check newest County Financial off India financing cost, FD interest rates

Most recent SBI loan, FD costs: Brand new marginal cost of funds-depending financing rates (MCLR) definitely loan durations might have been enhanced because of the Condition Bank of India (SBI) by the ten base points (bps) once more. This circulate usually lead to improved expenses for the majority individuals of user financing eg vehicles or home loans. The increased MCLR have been in perception of .

Home loan interest rates : Banks providing cheapest home loan interest rates for number more than Rs 75 lakh

Numerous points are thought of the lenders whenever deciding the speed of your house mortgage, just like your credit score, loan amount, LTV ratio, employment, and type of great interest price. Favor a loan provider whom has the benefit of a competitive rate of interest given that good financial are an extended-identity financial commitment.

- All of the

- Development

- Clips

RBI’s steeplechase with cyclic and architectural difficulties

Just like the RBI intensifies their regulating tightening, the fresh new financial sector will have to negotiate that have more sluggish development, straight down margins, and you may ascending borrowing from the bank will set you back. The newest central bank is also worried about the fresh present spurts in rates away from milk products and you will cellular tariffs, that can penetrate into the greater rising cost of living momentum.

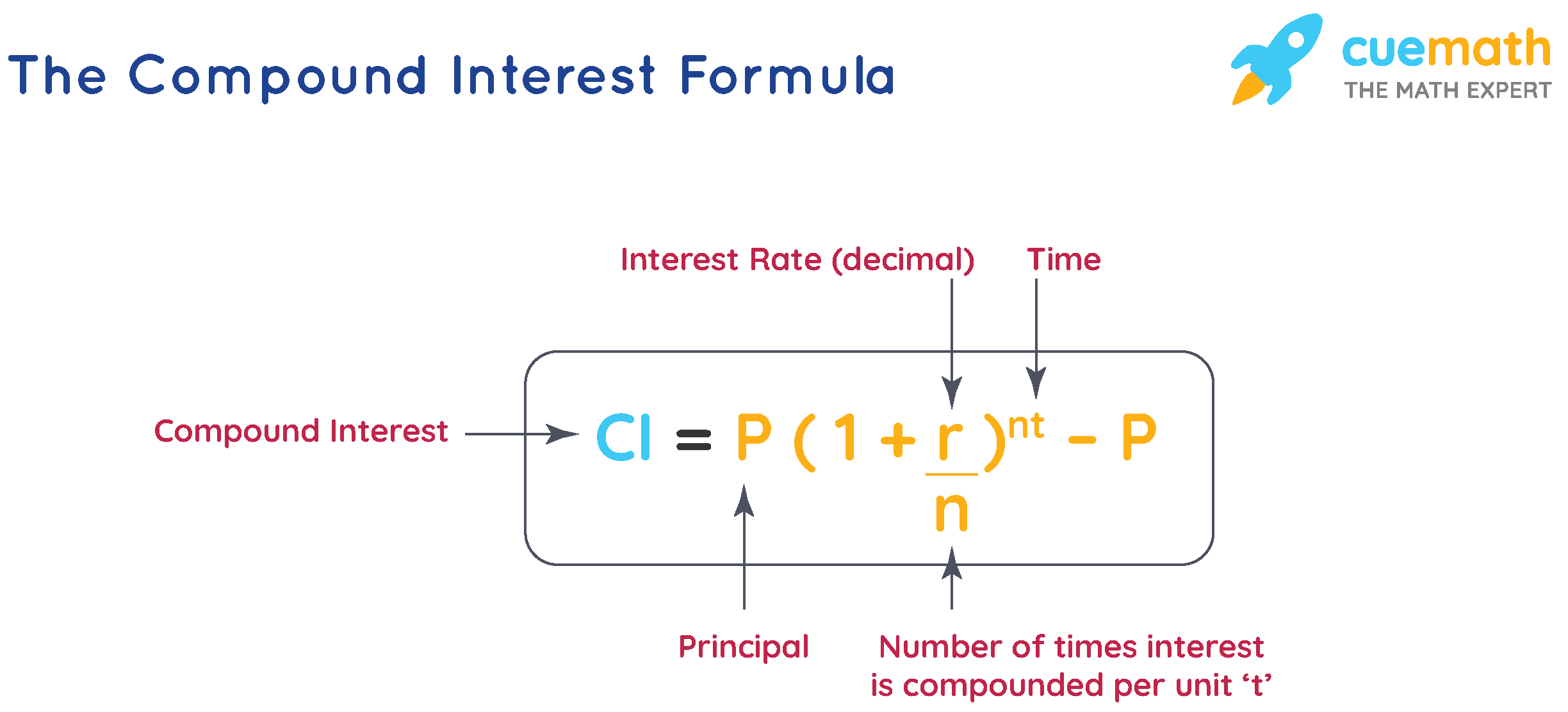

Fixed versus Drifting rates financial: See the difference

While puzzled because of the personal funds conditions, slang and you may computations, the following is a separate series to explain and deconstruct such to you personally. Regarding the tenth element of it series, Riju Mehta shows you the essential difference between both types of interest costs.

Attract subsidy to own middle class getting financial below P

The Pradhan Mantri Awas Yo inside India that aims to incorporate pucca households which have basic services to any or all owners, in outlying and towns. Pradhan Mantri Awas Yojana is divided in to two-fold: Pradhan Mantri Awas YoAY-G) for all of us in the outlying section and you will Pradhan Mantri Awas YoAY-U) for people remaining in urban areas. One another systems bring financial assistance to qualified beneficiaries to help them build a pucca home. All you need to learn about the revise inside the Pradhan Mantri Awas Yojana