what is an payday loan?

Equity is the difference in the current property value the property while the financing up against they

Throughout the years these types of this new variety of mortgage brokers resulted in a great surge for the lending and a nationwide rise in casing pricing birth from the later 1990’s

Rents, but not, always go up over the years. A homeowner and builds guarantee at home over the years. In the more than illustration of brand new $2 hundred,000 domestic, the particular owner quickly has actually $forty,000 during the collateral because of the advance payment; because the owner gradually pays back the borrowed funds, his or her equity grows. Also, chances are high a decade later on the house by itself often have raised when you look at the really worth. In the event your home is, eg, really worth $260,000 by then, the particular owner can get gathered an additional $sixty,000 into the guarantee. An owner is capable of turning this new guarantee in the a house for the dollars because of the selling our home and pocketing the profits, possibly on the aim of buying a unique house, bringing an extended vacation, otherwise which have more income to own senior years.

Current Styles

For the majority many years the only sort of home loan the typical people gets is actually a predetermined-price 15- or 30-12 months financing. About late 70s interest levels in america flower greatly. As the interest rate to have a home loan provides a direct effect on the dimensions of the loan percentage (highest rates of interest indicate higher monthly premiums), less somebody you may be able to get home otherwise be eligible for mortgages. This case was made more complicated because of the a high rate of rising cost of 5000 dollar loan poor credit Trinidad living (the overall rising of prices), and therefore decreased the worth of hardly any money that individuals got conserved upwards. So you’re able to encourage borrowing from the bank, lenders responded by offering brand new particular mortgages having all the way down month-to-month payments otherwise forcibly low interest rates. Among these was variable-price mortgage loans whoever interest (hence whose monthly payments) altered through the years and you will appeal-merely mortgage loans whoever monthly obligations integrated just the appeal on mortgage and no payment regarding prominent. That it pattern aided activate monetary development from the promoting income for those who purchased present properties and also for those people working in building brand new ones. The brand new financial community had a boost off somebody taking out fully 2nd or 3rd mortgage loans on the residential property so you can apply from over the years low interest rates. Certain economists speculated that these loans place the federal discount during the chance since a downturn into the construction costs otherwise a rise in interest levels would log off many people that have financing they may quickly no more be able to pay off, that’ll produce a giant rise in the number of property foreclosure across the country.

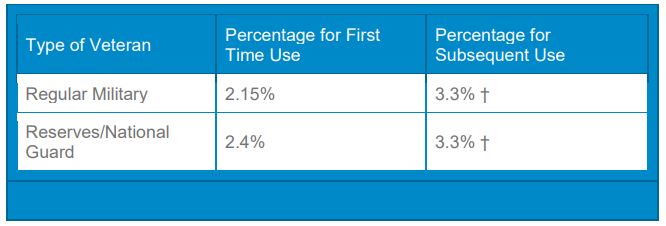

The process of a lender taking fingers out-of a house as a direct result a beneficial defaulted financing is called property foreclosure. Lenders check potential individuals to ensure he is credible enough to pay right back the borrowed funds. One of many situations it comment certainly are the borrower’s money and you may feature to make the down payment. The fresh U. S. regulators provides different forms out of assistance to individuals who would not typically be eligible for mortgage brokers. As an example, this new Federal Casing Government means finance for reduced-income citizens in order to prompt financial institutions so you’re able to lend on it. In addition runs applications that offer provides (money without is repaid) to pay for off costs. One particular program ‘s the Western Fantasy Deposit Effort. The Agency out-of Veterans Things provides similar direction for people who keeps offered regarding U.

If the yearly insurance rates expenses arrives owed, the mortgage providers uses the cash regarding escrow membership so you can spend it with respect to the newest borrower. At exactly the same time, really a house is actually at the mercy of possessions income tax, that is used to pay for social schools and other local government programs. Since a failure to expend this type of taxation may cause brand new seizure and you can product sales of the house, the lender desires make sure that this type of taxation are repaid and hence requires the buyer to expend another month-to-month amount with the the new escrow membership. Despite the lot of appeal paid back, there are many different benefits to having home financing. It allow people to buy house which they would if not be unable to manage. While doing so, after people have a fixed-rates mortgage, the brand new payment per month never rises.