how much interest on cash advance

Chances are everything you could well be great and you can be able to proceed with the closing

Individual mortgage insurance policies (PMI)

Private home loan insurance policy is usually needed in case your amount borrowed was greater than 80 per cent of one’s appraised property value your house (we.age. if you make a deposit less than 20% off the price). It protects the lender if the client standard to your loan. PMI is normally paid back per month, adding an added cost on the payment. Home owners get get rid of private home loan insurance policies immediately after a couple of years whenever they build home improvements while increasing the brand new collateral in their home to 20% of the brand spanking new appraised well worth otherwise if they has actually paid down 20 percent of the financing principal.

Final walk-owing to

In 24 hours or less of your own closing time, you will want to always check our house youre to get, one final time, to ensure that things are manageable. Your purchase contract is to county their intent to accomplish this. It’s your opportunity to make certain that any concurred-through to solutions have been made towards the pleasure, so all of the products and you will options work, also to search for one this new injury to the house. But not, in the event that you’ll find issues, its best to check out them up until the deal is closed therefore own the house. You can sue the vendor after for many who come upon big troubles or breaches of your package, however, this is a pricey and you may time-ingesting procedure. It is better and you may smarter when planning on taking one hour to walk-through the home ahead of closing and handle people difficulties till the house is up to you.

Closure steps

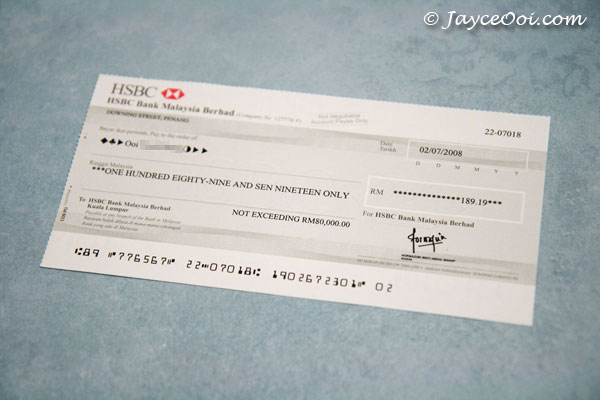

The fresh official closing fulfilling, otherwise settlement, is completed by closing representative, exactly who are a bona fide house broker, lawyer, member regarding lender or others. Part of the activity that happens within closing is learning and you can finalizing the certified files needed to import the fresh new possession of the property regarding vendor into the buyer. New settlement costs are reduced at this fulfilling, so be sure to give adequate currency for any needed costs. Certain costs have to be paid off with an authorized have a look at otherwise currency purchase, while others can up to 255 Maine online payday loans be reduced which have personal monitors. For those who have currently paid back a number of the closing costs, offer invoices to display that you have paid off them. In the event that all the goes better, the vendor gives you the newest secrets to the new house, and you may commercially feel a homeowner.

Protecting your investment

Shortly after with spent a great amount of go out, times, and money to become a resident, it is important that you cover disregard the. That it final section discusses three straight ways to accomplish this.

See enough homeowners insurance

Structure of the house and you will detached houses on the possessions Your house and adjacent property at your residence are covered when they was damaged otherwise shed because of the flames, hail or any other disasters. You need to ensure your house for around 80 % regarding the modern replacement for costs. Buy an insurance policy which takes care of many dangers. The most famous insurance policy is HO-step 3, a thorough coverage which takes care of every threats except those that is particularly excluded, such as for instance earthquakes otherwise flood. Based on where you live in the Missouri, it can be well worth the extra expense to invest in earthquake otherwise flooding insurance policies. Homeowners insurance might cover additional living expenses in case the domestic is actually broken very widely you need to live in other places up to they was repaired otherwise reconstructed.

Items in our home The new items in your house are also secure doing a selected dollar count if they are destroyed otherwise broken. A fundamental amount of personal possessions coverage is actually 50 percent of the amount of insurance into domestic. Take an email list of all of the their homes and maintain this listing from inside the a safe place away from your home. This will make it much easier to show just what must be replaced any time you need to make a state. Make sure that your property is insured for their replacement for prices, perhaps not the true dollars worth of what exactly. This may allow to you change your home in the most recent ount from what they’re indeed value (that is most likely a lot less). For those who very own expensive situations, including jewelry or rewarding collectibles, you could add unique recommendations to afford assets beyond the number specified from the new rules.