payday advance cash america

Why you ought to pay back your residence mortgage faster?

If you do not keeps paid new a good loan, failing to pay your residence mortgage may have significant outcomes, because it can get a bad influence on your credit score therefore it is tough to supply credit later. Or even correspond with the bondholder and come up with an agenda, they may simply take legal action and you may repossess the property market they to recoup the fresh a great financial obligation. In case the deals rates will not shelter the balance you borrowed from, additionally, you will feel responsible for one punishment, late charge, and focus costs, next boosting your economic load. Constantly keep in touch with your own financial while incapable of spend your bond to be able to mention alternative solutions, instance loan restructuring otherwise refinancing.

Disclaimer: RE/Max SA advises website subscribers locate elite monetary suggestions and cannot become held accountable for financial choices in line with the posts of this informative article. All the computations was installment loan Pennsylvania calculate as well as illustrative objectives merely.

Opting for another Hometown: Relocation 101

There are a myriad of reason anybody relocate to the fresh new metropolises or places, anywhere between advancing years and you can life alternatives, so you’re able to transmits and you can a job oppor

The fresh new Perception of your own Repo Speed in your Home loan

For individuals who hold any financial obligation, it is important to continue a near eyes with the interest rates: since the rates rise, very do your month-to-month repayments. The latest inter

Learning to make another town feel domestic

Swinging residence is one of many better four lifestyle stressors plus more so in the event the disperse is not just in one family to a different, however, to a different city otherwise nation.

The way to select fencing which will boost property value

Do i need to favor walls or walls when starting a fringe doing my personal household? And you may and this ones solutions can add value on my assets? The solution depen

Creating Solar all you have to discover

To the global development towards the renewable energy, men need to solar power as an option to plugging on head grid – especially i

Do you want examining the potential for paying off your own home loan early? We now have prepared a collection of solutions to help you repay your house financing shorter.

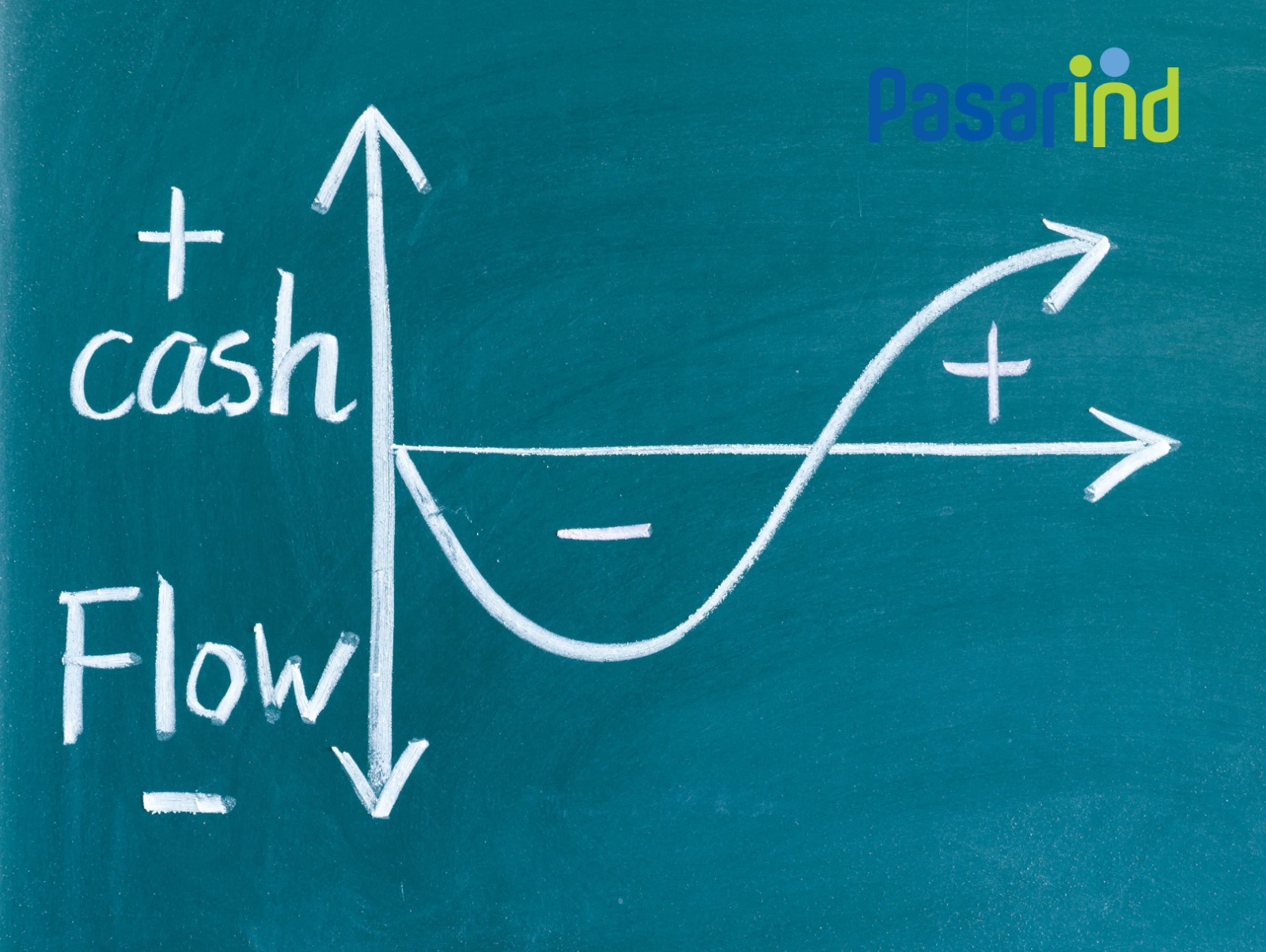

Possessing property is a big milestone, although much time-term commitment away from a loan would be overwhelming. You could potentially get rid of years’ worth of debt if you are paying even some extra in the monthly thread – of big date one or as quickly as possible. A few of the specific positive points to repaying your property loan more quickly tend to be:

a beneficial. Saving toward interest

Adding to their minimal financial installment implies that you save somewhat on focus repayments. Instance, when you have an R1,five hundred,000 bond over twenty years, from the prime credit rate regarding %, paying off the loan in just 15 years can save you in the R684, from inside the focus will set you back*. That it bucks should be directed towards after that investments or perhaps into the improving your overall monetary safeguards in old age.

b. Releasing your self out of debt

Think of the assurance that accompanies being thread-free. Together with effortlessly investing reduced focus, paying your home financing ahead of time will provide you with way more monetary independence. With no burden of your house financing, you need this new freed-right up financial resources with other opportunities, old age discounts otherwise personal passion (such as from that point enterprising dream about beginning their Lso are/Maximum Work environment, perhaps?).

c. Increasing your security

For those who have an accessibility thread, paying off your property financing easily happens give-in-hand that have strengthening the guarantee about assets and you may building your budget. Which increased equity was an asset which can render a good base to own coming ventures, including home improvements, or a lesser-interest replacement car loan.