what is advance cash loans

Main Financial out-of Asia Financial EMI Calculator

The newest Main Lender of India Mortgage Calculator is a vital equipment for prospective individuals. They aids in deciding brand new monthly costs according to more mortgage number, rates, and you may tenures. Of these considering applying for financing, the home Financing Qualification Calculator provide next guidelines.

Making plans for your home loan repayments becomes easier to the Main Financial off Asia Mortgage EMI Calculator. Which device helps you determine their monthly EMI, allowing for most useful monetary believed. To have a comprehensive analysis, go to the Mortgage EMI Calculator.

Very important Monetary Areas of Main Lender of Asia Mortgage brokers

Understanding the very important financial regions of lenders is crucial to possess any borrower. The latest Central Bank off India will bring transparent and you will competitive products so you’re able to meet the needs from a broad customers.

Rates of interest Investigation – What you need to See

Interest levels to the Central Lender out of Asia mortgage brokers are aggressive, having cost ranging from 8% upwards. This will make it more relaxing for individuals to help you safe financing within an installment-effective rates, ensuring that owning a home is far more accessible to a larger audience.

Charge and you can Fees – Outside of the Interest rate

Aside from the rate of interest, borrowers also needs to thought almost every other fees and you may charges. These could become a maximum Rs API integration charges, which covers the expense of handling the loan software and you can keeping this new account.

Documentation Fees – best personal loans Kansas Staying They Clear

The brand new Main Financial away from Asia maintains openness within its records fees to possess lenders, making sure borrowers are well-advised regarding the the can cost you in it.

- A moderate percentage, that have a total of Rs 20,000, is actually energized to pay for expenses regarding running the borrowed funds software. This fee has the price having courtroom confirmation off assets documents, performing a home loan, and other administrative work.

- The financial institution along with levies API consolidation charges off Rs five-hundred, a small rates into the capacity for smooth file handling and you will verification procedure.

By keeping this type of costs obvious and you will initial, the financial institution is designed to create believe and get away from people unanticipated economic weight into the borrower.

Quantum away from Loan – How much Can you Obtain?

New Main Bank from India evaluates the newest quantum away from financing dependent for the paying down capability of your own applicant, which is actually determined by things such regular money as well as the yearly earnings-smart rated ratio. The bank ensures that candidates having a steady terrible annual money can safe an amount borrowed one matches the housing demands whilst aligning making use of their monetary stability. This process helps in tailoring loan number that are sensible and you may aligned into borrower’s monetary opinions.

Navigating the application Techniques

Trying to get home financing in the Central Financial off India are sleek to greatly help candidates during the navigating the procedure easily. Throughout the first query toward finally recognition, the bank will bring advice and service, making certain that applicants see each step. It supporting means was created to result in the excursion into protecting a home loan transparent and less overwhelming for prospective people.

Qualifications Standards – Guaranteeing You Be considered

The new Main Bank out of India enjoys lay obvious qualification requirements having their home loan applicants to make certain an easy procedure. Toward day out of app, the bank assesses whether candidates meet with the financial away from Asia domestic loan eligibility, which includes that have a lakh or maybe more for the typical earnings and you may becoming section of acknowledged co-surgical communities. This implies that individuals that have a steady income stream are thought, making the processes fair and you can accessible.

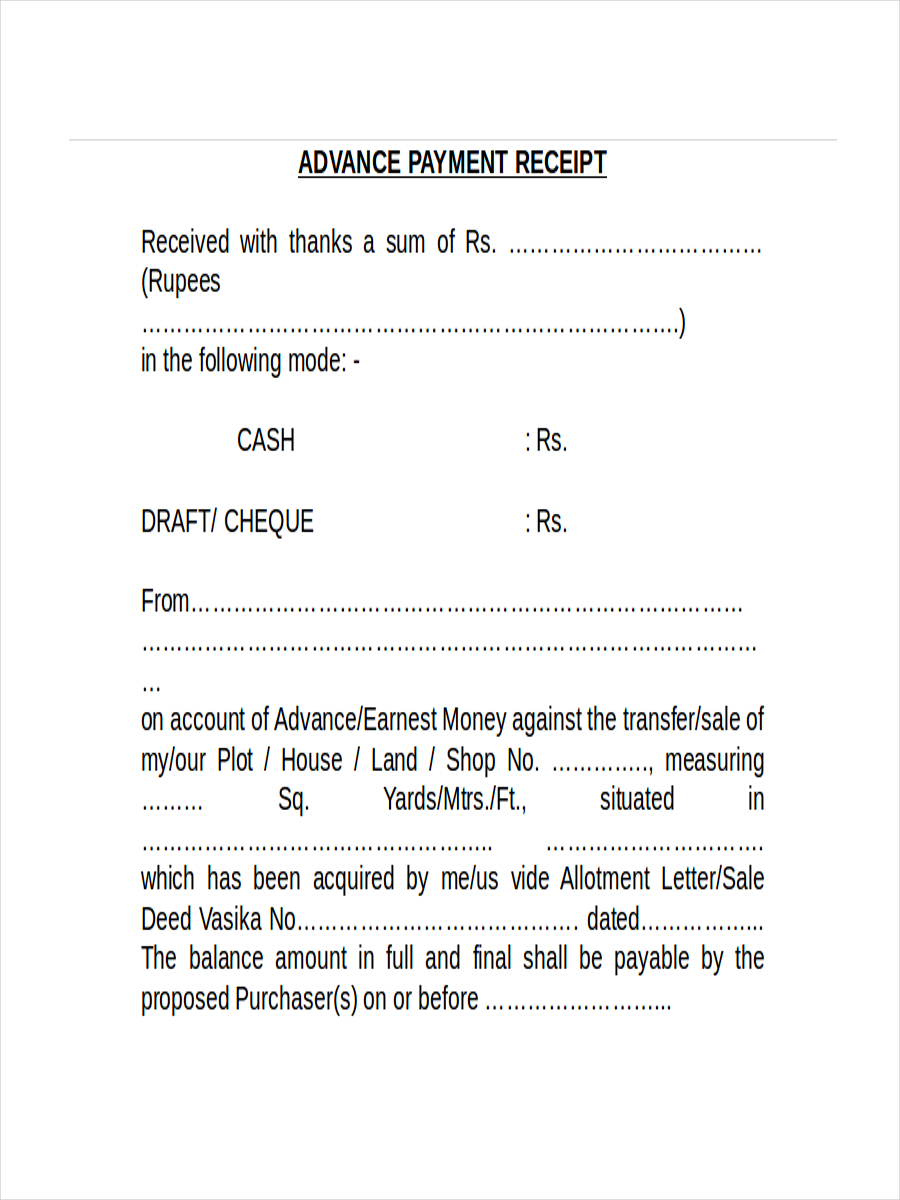

Data files Needed – Making preparations The job

For home loan applicants, the latest Main Lender regarding India means a collection of secret documents in order to process the program. They’ve been identity and you may address proofs such a cooking pan cards, Aadhaar card, Voter ID, and you may driving license. By giving these data files, individuals improve the financial during the verifying its name and you can house, that’s a critical step in the home application for the loan techniques.