how much to pay for payday loans

One-Go out Close Funds are available for FHA, Virtual assistant and USDA Mortgage loans

FHA financing rules require an appraisal of the house secure by the the loan it doesn’t matter if it’s a preexisting framework family or if you build your self home using good One-Big date Close mortgage.

However FHA appraiser finds a thing that will not meet local strengthening password, or if perhaps discover some sort of destroy exposed during the assessment (these are just two samples of what might happen in the assessment go out into yet another framework home) people activities must be corrected.

HUD 4000.step one, this new FHA Single-Family home Mortgage Guide, instructs the financial institution you to definitely in the event new assessment uncovers anything which do not meet up with the FHA minimal property fundamental, the fresh new Appraiser need certainly to report the fixes needed seriously to make the Possessions follow, bring a projected pricing to treat, provide descriptive photo, and you will condition the fresh assessment to the called for solutions.

FHA Financing Appraisal Requirements: Fixes

However, that projected costs to correct the issues must also see FHA direction. They become, however they are not limited to help you, conditions for the following:

In the event the compliance is only able to become effected from the significant repairs otherwise modifications, the fresh new Appraiser need to report every conveniently observable property inadequacies, and additionally people desperate situations discovered carrying out the study involved for the achievement of one’s assessment, in revealing mode.

- take care of the protection, coverage and you may soundness of the property;

- manage the proceeded marketability of the home; and you will

- protect the and you can coverage of one’s occupants.

The fresh structure belongings are not 100% defect-totally free 100% of the time. Individuals shouldn’t imagine an alternate design house is primary, and it’s crucial that you enjoy the need for more conformity checks and other expenditures about new assessment when corrections are required.

You might not in reality invest any cash (if you have zero significance of a conformity assessment, like, after all) but that have those funds while should be a huge let later throughout the mortgage techniques.

Such finance also go by the following names: step 1 X Close, Single-Intimate Mortgage or OTC Loan. Such financing allows for that loans the purchase of one’s residential property plus the build of the house. It’s also possible to play with belongings that you very own 100 % free and you can obvious otherwise provides a current financial.

I have over extensive search into FHA (Government Housing Administration), the new Va (Agencies of Veterans Issues) and also the USDA (Us Company of Agriculture) One-Day Close Framework financing apps. I have spoken right to subscribed lenders one originate these domestic mortgage systems in most claims each providers possess provided us the rules for their items. We can hook you having mortgage officials who do work for loan providers you to definitely be aware of the tool well and have now constantly considering high quality provider. When you are seeking becoming called to just one registered framework bank near you, delight posting responses to the issues lower than. Most of the information is treated in complete confidence.

OneTimeClose will bring advice and you can links users to help you certified You to definitely-Day Romantic lenders in order to raise feeling regarding it mortgage product in order to help customers found high quality services. We are really not taken care of endorsing or recommending lenders or loan originators and do not if you don’t take advantage of doing so. People should look for mortgage services and contrast its choices prior to agreeing to help you go-ahead.

Please note that investor guidelines for the FHA, payday loans Moores Mill VA and USDA One-Time Close Construction Program only allows for single family dwellings (1 unit) and NOT for multi-family units (no duplexes, triplexes or fourplexes). You CANNOT act as your own general contractor (Builder) / not available in all States.

Additionally, this can be a partial listing of the second residential property/building appearances which aren’t desired under these types of programs: Package Land, Barndominiums, Vacation cabin otherwise Bamboo House, Shipments Container House, Dome Property, Bermed Environment-Sheltered Homes, Stilt Land, Solar (only) or Cinch Driven (only) Land, Smaller House, Carriage Houses, Accessory Hold Systems and you will An effective-Presented Land.

Your own email to help you authorizes Onetimeclose to fairly share your own personal pointers that have a mortgage construction lender authorized towards you to contact you.

- Send your first and you may past name, e-mail address, and make contact with telephone number.

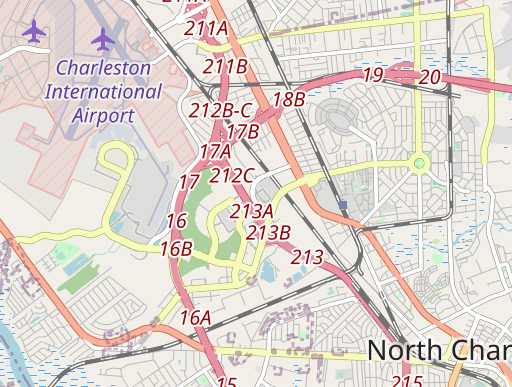

- Inform us the metropolis and you can state of your own advised property.

- Let us know the and you will/or perhaps the Co-borrower’s borrowing reputation: Expert (680+), A (640-679), Fair (620-639) otherwise Bad- (Lower than 620). 620 is the minimal qualifying credit history for it product.

- Are you presently otherwise your spouse (Co-borrower) eligible experts? In the event the sometimes people qualify veteran’s, down payments as low as $ount your debt-to-income proportion Va allows there are not any limitation mortgage quantity as per Va direction. Most lenders will go doing $1,000,000 and opinion highest financing quantity to the a case by the circumstances foundation. If not an eligible seasoned, new FHA advance payment try step 3.5% up to brand new maximumFHA financing limitfor your state.

Bruce Reichstein features invested more thirty years as an experienced FHA and you will Va home loan mortgage banker and underwriter in which he had been responsible for financing Billions inside the government supported mortgage loans. He or she is this new Handling Editor to possess FHANewsblog in which he educates people into certain guidance for getting FHA protected home loans.

Archives

- 2024

On the FHANewsBlog FHANewsBlog was released this year by seasoned home loan gurus trying to instruct homeowners about the assistance for FHA insured home loan funds. Preferred FHA information are borrowing requirements, FHA financing limitations, home loan insurance fees, closing costs and even more. This new article writers have written tens of thousands of blogs specific so you’re able to FHA mortgages and the site enjoys considerably improved audience over the years and was known for their FHA News and you will Views.

Brand new Virtual assistant One to-Day Personal is actually a thirty-seasons financial available to veteran borrowers. Borrowing assistance are prepared of the lender, usually which have an effective 620 minimal credit score needs.