bad credit loans payday advance

USDA Financing Programs 100% Family Purchase

seventh Level Home loan makes it much simpler in order to be eligible for 100%, No cash Down USDA financing applications when you look at the New jersey, Ny, Pennsylvania, Virginia, Maryland, Texas, Florida, Colorado and Ohio!

USDA Rural Innovation mortgage loan fund are especially built to let lowest to reasonable money home and you can very first time home buyers buy property inside USDA eligible outlying components. seventh Peak Financial now offers USDA mortgage software which you can use purchasing a current domestic, create an alternative home away from scratch, or make solutions otherwise renovations to a current USDA eligible outlying possessions. These money could also be used to improve water and you can sewage possibilities in your outlying property, if you don’t used to move around in a property altogether. USDA financial programs appear in most of the condition seventh Top Mortgage is actually subscribed accomplish home loan credit and additionally New jersey, New york, Pennsylvania, Virginia, Maryland, Colorado, Florida, Tx and you can Ohio. General qualification direction on program are exactly the same during every condition, although not per state centered on income and populace occurrence. Thankfully that should you need a property mortgage off 7th Peak Financial in one possibly New jersey, Nyc, Pennsylvania, Virginia, Maryland, Texas, Florida, Tx and you may Ohio very areas on these claims meet the requirements!

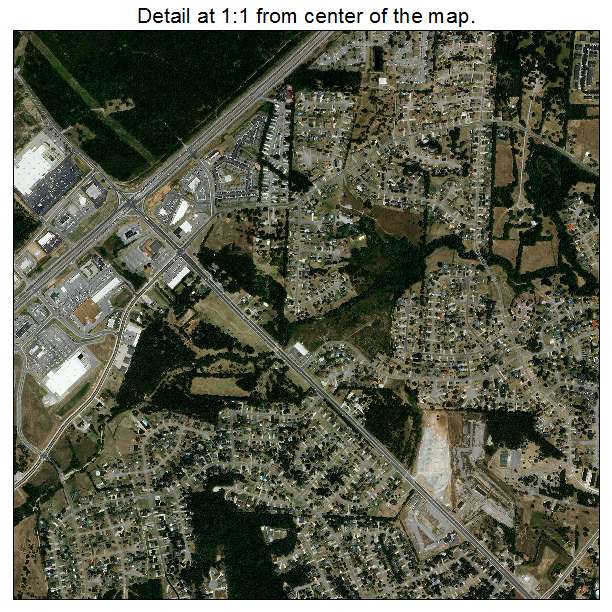

USDA Qualified Parts

Whenever you are interested in a great USDA home, the next step is to ascertain whether or not the domestic your thinking of buying is currently for the an effective USDA eligible urban area. USDA qualified section start from state to state and are generally determined centered on several different factors. Having a location to get USDA qualified it must be located inside an outlying urban area. The fresh USDA talks of a rural city once the people area which is rural in the wild which can be not section of otherwise for the a city, or any town, village or area and it has less than 10,000 owners. Most other shorter outlying portion beyond big people stores which have a big shortage of home loan borrowing from the bank get be considered that have populations ranging from ten,000-20,000 residents. A few of these elements may well not even be outlying in nature, but have communities regarding lower than 20,000 as they are not associated with the people significant city or towns.

USDA Money Constraints

While the USDA outlying lenders is actually designed only for lowest in order to reasonable earnings houses, there are specific earnings constraints in place in check qualify. In order to be eligible for an excellent USDA financial, your current yearly family income shouldn’t surpass 115% of your average average money regarding brand of area. Based what your location is deciding to purchase your household, money constraints are high or down based on that one area’s average median earnings. Eg, when you find yourself deciding to get a beneficial USDA eligible possessions inside the The new Jersey the money restrict is pretty much across-the-board set at $91,500. To own a complete selection of USDA qualified counties, as well as their earnings restrictions you can check out that it hook or contact one of our mortgage agencies only at seventh Top Mortgage.

Because potential buyer enjoys discover a beneficial USDA eligible assets, the property have to meet specific USDA mortgage standards, generally speaking this type of requisite are identical for everyone authorities insured fund. Most of the properties must be modest in general and you can fulfill every created requirements imposed from the State and you can regional governments.

Generally speaking, 7th Peak Home loan can help any debtor with fico scores off 620 or ideal be eligible for a great USDA real estate loan for the The new Jersey, New york, Pennsylvania, Virginia, Maryland, Tx, Fl, Texas and Kansas. For those who have good credit that have slight borrowing from the bank blips here and you can here we would be capable of getting your certified, all you need to would are contact one of our staff otherwise complete the contact form less than in order to learn.

USDA Loan Refinance Solution

When you have already received a great deal to your a good USDA financial, you might be astonished to know that you can aquire a level better price towards a great USDA home mortgage refinance loan. USDA re-finance fund are only entitled to newest USDA financing and are quick and easy no possessions assessment. You will find several additional refinance finance readily available in addition to improve and you may low-streamline refinance fund, with many finance requiring no household assessment and others allowing you to finance the closing costs toward total prominent of your financing. And one of the best pieces regarding the USDA re-finance funds is that they guarantee your brand new USDA mortgage will result in good straight down monthly mortgage repayment than you may be purchasing today.

Note: By entry your own request, your give permission to have seventh Peak Financial to installment loan Lawrence NY contact you of the current email address or of the mobile phone.